By Tomaso Ferrando, Gabriela de Oliveira Junqueira, Iagê Miola, Flavio Marques Prol, Diogo R. Coutinho

For years, ‘green’ and ‘climate’ investments were considered a high-risk and ‘niche’ territory for environmentalists and socially oriented enterprises. However, between 2010 and 2019, more than EUR 2.28 trillion of private and public capital went into building new renewable capacity globally, primarily solar and wind energy. This reveals a new appetite for financing projects that are supposed to favor climate change mitigation and – although in a smaller percentage – climate change adaptation. With the combination of the climate emergency, the covid-19 pandemic and the global recession, the idea of ‘privately financing green growth’ has become the mainstream political, academic and business narrative.

Of all the tools used to ‘celebrate the marriage’ between decarbonization, economic growth and private finance, Green Bonds are one of the most prominent. Green bonds are debt contracts concluded between an issuer and a creditor whose proceeds are earmarked to fund projects that are associated with environmental benefits. They have been depicted as promising financial tools with the potential of being a straightforward and easy way of financing the low-carbon transition. In the year 2020, an estimated total of USD 290,1 billion was issued in green debt globally, and the expectation is that the overall amount of green debt may achieve the 1 trillion USD milestone by the end of 2022.

In this context, a more critical approach is needed and already emerging: one that conceives green bonds as financial products embedded in the complexity of the socio-environmental networks underlying the financial transaction and in the power dynamics that are inherent to the crystallization of debtor-creditors relationships.

If everything can be green, what is green?

In 2014, a 2,5-billion-euro green bond issued by the French electric utility corporation GDF Suez (renamed Engie in 2015) to fund renewable energy was rewarded with the Pinocchio Award, a “prize” by civil society organisations to denounce contradiction between multinationals’ speech & actions on their social & environmental impacts. The argument was that the launch of the bond was characterized by an abusive and deceiving communication campaign on the environmental merits of the projects being funded. Among other projects, the proceeds had been used to finance the Jirau dam in the Madeira river in Amazon, accused of being a destructive project with enormous and irreversible impacts on ecosystems and local indigenous communities.

If there is no doubt that private standards risk to be adapted to the needs of the investors and issuers rather than the climate emergency, public taxonomies can be equally problematic. In 2016, for instance, the Central Bank of China released its ‘Guidelines for Establishing a Green Financial System’, a taxonomy of project categories that could be considered ‘green’ and, therefore, financed through green bonds. Among the categories was the oxymoron ‘clean coal’, another way of connotating investments in coal-fired power.

And the situation is not better in the European Union. There, the ‘technical’ documents associated with the Green Taxonomy have already raised strong criticism. In the last months, two-hundred and fifty organizations (including the Climate Bonds Initiative) signed a letter to ask for the exclusion of coal-to-gas and cogeneration (CHP) from the Taxonomy, and public outcry has erupted when the Commission has confirmed that nuclear and gas would be considered as green.

The funding of coal or oil projects may appear evidently incompatible with the general public’s notion of green, and indeed they are excluded by several of the governance regimes described above. Beyond that, however, the spectrum of ‘greenness’ is a controversial space whose boundaries are defined by means of political pressure, economic strategies and visions of the future. For example, solar, wind and hydroelectric energy projects that may appear more aligned with the notion of ‘green’ may be linked with land grabbing, environmental disasters and deforestation, human rights violations and greenhouse gas emissions due to the extraction of the minerals needed for these technologies.

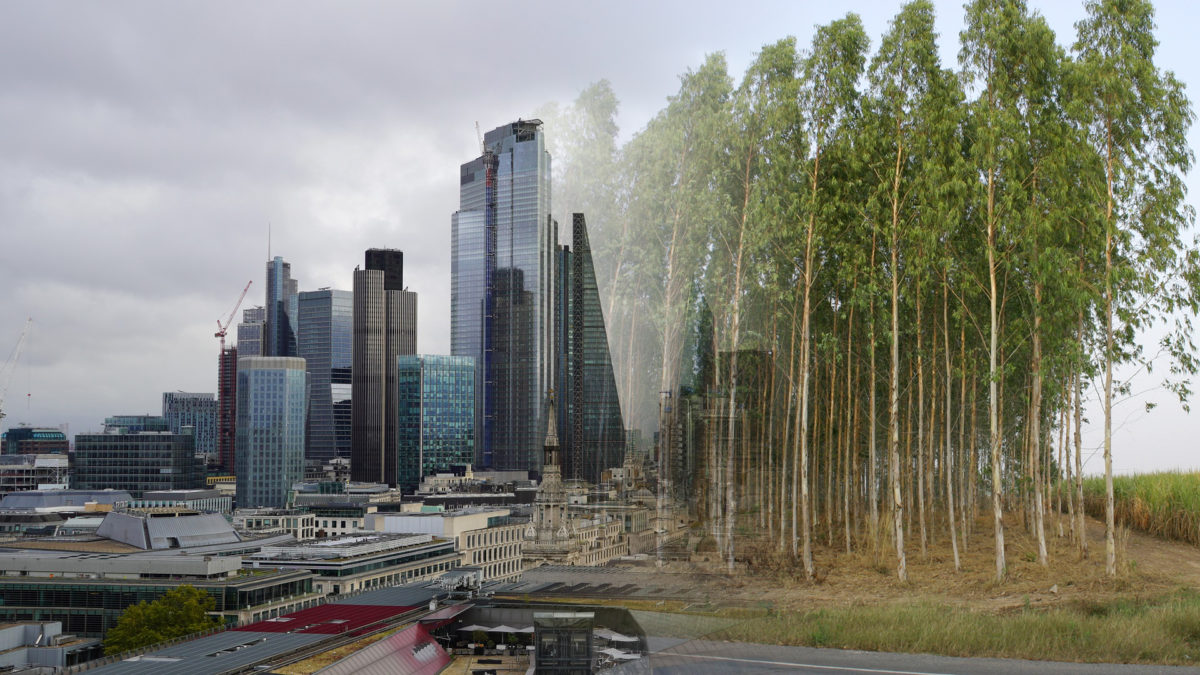

Similar considerations can be applied to the forestry industry and other economic activities that may be generally associated with a notion of green, but are often linked with the generation of severe socio-environmental problems. In Brazil, for example, several green bonds have been issued in this sector. This very sector, however, is subject to strong criticism by indigenous people, civil society organizations and academics because of the promotion of detrimental monocultures, the change of land use, the extraction of water and the impact on indigenous communities’ rights. The risk is that the ‘green rush’ alimented by private capital over-simplifies the complexity of territories and ecosystems, and that the definition of ‘green’ is left to ‘technical’ assumptions that overlook the political nature of the whole process.

Green without social: saving an unequal planet?

A related issue barely addressed by mainstream literature is the relation between green bonds and people’s livelihoods. This concerns both the increase in debt contracted by public and private actors as well as the materiality of the projects that are financed. In other words, the attention on the pro-environment character of the bonds tends to overlook the way in which green bonds incorporate social considerations and the social repercussions of the expansion of debt as an instrument for environmental transition.

Examples from everywhere in the world highlight that the decision of issuing green debts and the ‘mission’ to save the planet from climate change are not just a technical matter that depends on economic considerations and the work of climate engineers. Green and a climate change mitigation (and adaptation) policy is a deeply political issue with potential long-term implications on livelihood, human rights and the whole ecological web of life. Moreover, the emergency that some financiers and policy makers are putting behind new investments for addressing climate change should not be to the driver of reproducing historical inequalities or sacrificing people and communities. Unless the goal is to save the planet through intensifying existing socio-economic inequality. Otherwise, the first step would be to subordinate the issuance of green bonds to criteria of socio-economic justice that not only address the material harm but are also informed by the long history of indebtedness that characterizes the North-South relationship and by the long-term repercussions that may have on both public and private issuers. The question is whether this is compatible with the desire to remunerate private creditors.

Green dots in a brown sea

A final element worth attention is the link between green bonds as sources of funding and the complexity of value chains that cut across multiple jurisdictions and keep together (materially and immaterially) a multiplicity of people, territories and economic activities. Eucalyptus plantations, for example, are just the first step in a long chain of paper and pulp that also includes the transformation, transport, consumption and disposal of the products realized with the plant. Similarly, green bonds that finance the installation of solar panels or wind turbines are often focusing on the installation phase, neither addressing the long chain of activities that is needed to realized and install these technologies, nor the way in which the generated energy is going to be used.

The moment we embed the ‘green’ investments into a broader spectrum of activities, we realize the need to abandon the current approach to green bonds as mere forms of financing specific economic activities. One emblematic case from Brazil can best explain it: Ferrogrão. This is part of an infrastructural program launched by the Brazilian Ministry of Infrastructure that authorizes the construction of three railroads by the private sector, to be funded via the issuance of green bonds. A Green Bond Framework was drafted and CBI-certified green bonds are expected to be issued to raise the funds needed for the projects. The public-private framework was externally reviewed by Ernst Young that attested the adherence to the Climate Bonds Standard, including the Low Carbon Land Transport Eligibility Criteria.

What is not discussed in the green standards, or mentioned in the public conversations around Ferrogrão, is that it is part of a logistics infrastructure that has already generated negative socio-environmental consequences on the Tapajós river. Moreover, the Ferrogrão project is going to affect indigenous communities, that voiced the complain that they have not been granted the right to previous consultation. More importantly, the idea that the railroad is green(er) than roads completely obliterates the fact that the project is associated with the expansion of soy monoculture in Brazil and the connection between these territories and the international ports located along the Amazon river and the Atlantic coast. Historically, the improvement of the logistic routes has increased the likelihood of deforestation and the incentives towards producing tradable goods: Ferrogrão may not be different.

Like a green dot in brown sea, the Ferrogrão case in Brazil makes evident that the sectoral approach of finance to green bonds allows them to fund projects that – even when complying with standards and requirements – can be part of broader chains that are at odds with the overall goal of preventing climate change, restoring biodiversity and achieving the Sustainable Development Goals. From a developmental perspective, we challenge the idea that private and public investors should be allowed to strategically label ‘green’ pieces of larger value chains that are scantly entangled with environmental and social impacts. Isn’t the production and transport of a ‘brown’ commodity like soybeans also affecting the logistic system that is transporting it? Should the reduction of greenhouse gases be promoted even when it affects indigenous communities? The extent to which green bonds in key infrastructure projects should be holistically compatible with environmental and social policy approaches and development strategies is a controversial and still ill discussed topic.

This blog draws on data collected in the research project “Green Finance and the Transformation of Rural Property in Brazil: Building New Theoretical and Empirical Knowledge”, funded by the Newton Fund of the British Academy (Newton Fund Advanced Fellowships 2017 RD 03 -NAF2R2\100124).

Note: This article gives the views of the author, not the position of the EADI Debating Development Blog or the European Association of Development Research and Training Institutes.

Tomaso Ferrando is is research professor at the Faculty of Law (Law and Development Research Group) and Institute of Development Policy, University of Antwerp. He researches the legal construction of the global food systems, the role of law in global production networks, and the co-optation of the ‘green’ transition. Currently, he is a member of the Legal Action Committee of the Global Legal Action Network (GLAN), where he is in charge of the land rights’ thematic area, and the President of FIAN Belgium, a non-governmental organization engaged in the promotion of the right to food and food sovereignty.

Gabriela Junqueira is a PhD candidate at the University of São Paulo, Faculty of Law, Commercial Law Department. She holds a researcher position at the Project “Green Finance and the Transformation of Property in Brazil”. Her main research interests focus on capitalism’s institutional transformations to respond to the ecological crises, especially the transformations on the corporate form.

Iagê Miola (Brazil) is a law professor at the Federal University of São Paulo and a researcher of the Brazilian Center for Analysis and Planning. He obtained a PhD from the University of Milan and has held visiting positions at the New York University (NYU) and the International Institute for the Sociology of Law (IISL). His main research interests focus on the roles of lawyers and legal institutions in the economy, in areas such as green finance and the regulation of corporate power.

Flavio Marques Prol is is a researcher of the Brazilian Center for Analysis and Planning. He holds a PhD, a master degree and a LLB from the University of São Paulo Law School. He was a Fox Fellow at the MacMillan Center for International and Area Studies at Yale University and a Visiting Researcher at the Institute of Global Law and Policy (IGLP) at Harvard Law School. His main research interests focus on the roles of legal institutions in the economy, in topics such as green finance and macroeconomics.

Diogo R. Coutinho is a law professor at the University of Sao Paulo. He holds a master degree in Regulation (LSE) and a PhD in Law (USP). He has been a visiting professor at CTLS (Center for Transnational Legal Studies) and a researcher at IGLP (Institute of Global Law and Policy) and at the Brazilian Center for Analysis and Planning. His main research interests are regulation, competition and innovation policies, as well as the relationships between law, political economy and institutional change.